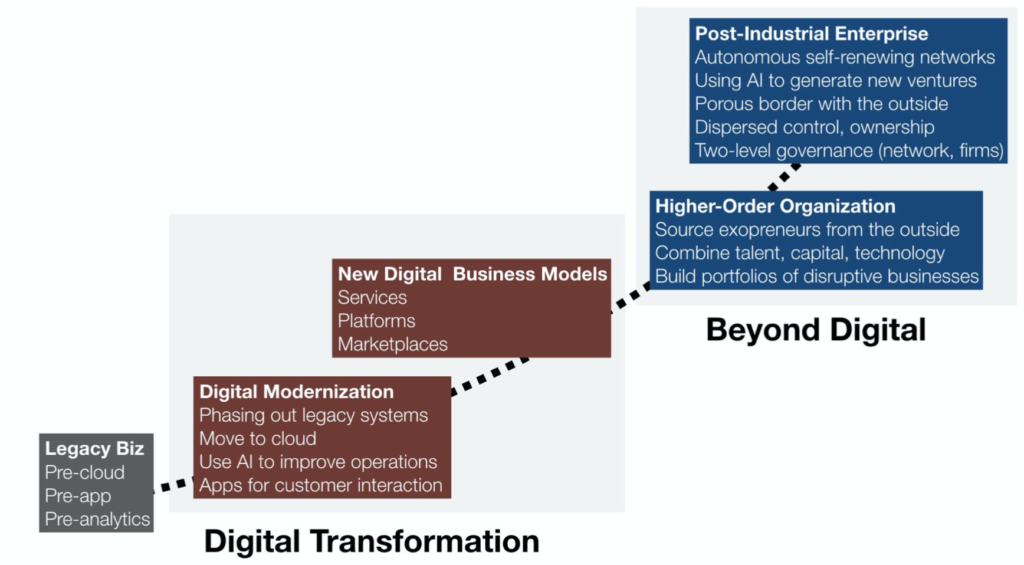

We are entering a Post-Industrial Transition powered by a combination of exponential technology development and decentralization. While there is much talk about digital disruption, most enterprises today are focused on digital modernization.

Digital modernization is not about industry disruption. It involves introducing new technologies to improve customer acquisition, operational efficiency, and customer satisfaction. For mature business units, there is no way around this except possibly early divestiture.

Operational improvements enabled by new technologies include:

- using AI to anticipate customer needs

- self-service solutions for ordering new services

- large-scale automation using AI and robotics

- using AI for hiring and career development

- enhancing customer experience with apps

- creating supply chain transparency with DLT

- using sensors and IoT to monitor assets

- using AI to improve customer support

Platforms such as Google Cloud, IBM Cloud, Amazon AWS, and Microsoft Azure provide backend support for implementing such solutions in the cloud. Startups also offer cloud-based applications to support virtually every organizational function. Cloud-based services can also be used to implement new digital business models. These include freemium, subscription models, service aggregation, and marketplaces.

The basics of digital models are already well understood. If every enterprise implements these models, where is the sustainable competitive advantage?

While tools such as the Business Model Canvas allow us to go into the details of each business model, it is also critical that we understand their relationships. One of the Post-Lean strategy tools we have developed, the Value Stack, arranges business models in a manner that combines distance from the customer with capital efficiency.

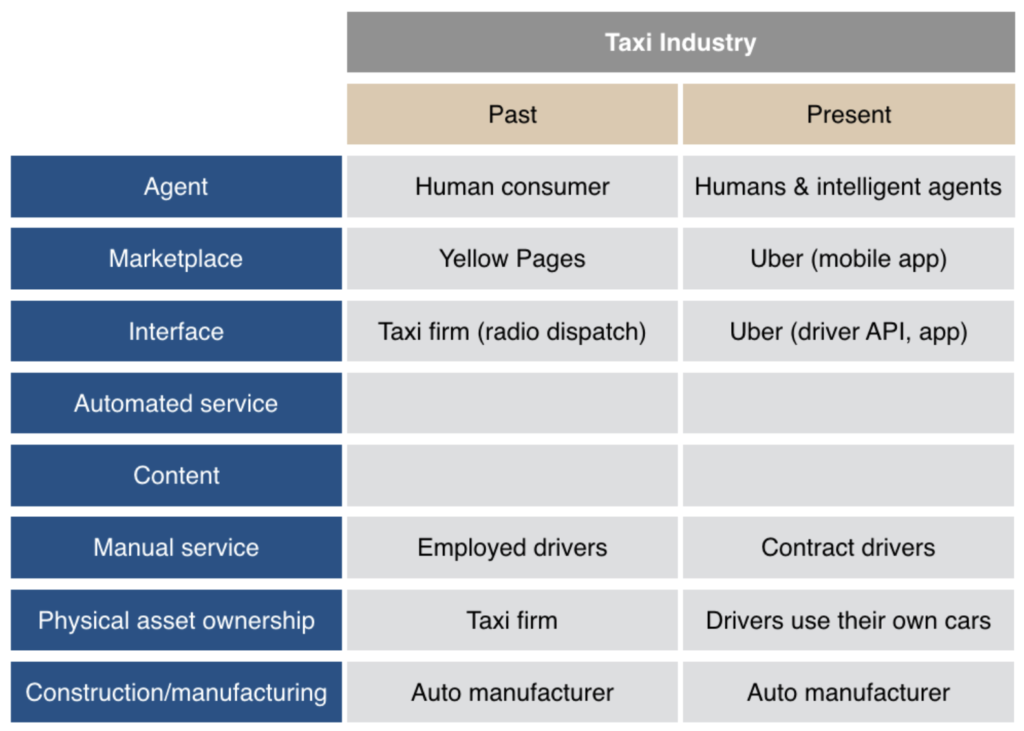

Figure 1: Example value stack for the taxi industry

The layers in the value stack are as follows.

The construction/manufacturing layer is where firms produce physical products, buildings, and infrastructure. Significant assets are managed for asset utilization, which takes place in the physical asset ownership layer. Here we find real estate holdings, car rental companies, and airlines.

The manual service layer is where we find cleaning companies and professional services firms such as law firms and accountancies. The bottom three layers are the physical layers of the value stack, since they depend on humans and/or physical assets for delivering value.

The content layer is where we find entities such as Netflix, Hulu, and DisneyPlus. The automated service layer contains services other than content streams. Here we find SaaS offerings from B2B and B2C applications to online gaming.

Business models in the interface layer keep track of people and assets further down the value stack, and these can then be made available in the marketplace layer through a digital marketplace. Airbnb and Uber are located in the interface and marketplace layers of their respective industries.

The agent layer is where products and services further down the value stack are curated and ordered with the help of consumer-facing AIs. Amazon, Apple, and Google all now provide agents with rudimentary recommendation capabilities – Alexa, Siri, and Google Assistant.

Amazon is in the lead here. Since it is also the online retailer in the world, Alexa can fulfill orders. Alexa is extensible through developer APIs, and there are now more than 100,000 “skills” available as of December 2019, making it a multi-billion dollar business for Amazon.

As intelligent agents get smarter, we will trust them to coordinate activities, manage communication, and recommend services. Agent brands will become powerful enough to challenge consumer-facing brands, reducing many of them to ingredient brands. An obvious counter-move will be to develop narrower agent brands focusing on smaller domains, such as nutrition and exercise.

Specialized agents can find a large audience by being added as extensions to existing general-purpose agents. At the same time, the technology for building new stand-alone agents will also increasingly become off-the-shelf. An “ecology” of agents will surround us, and are likely to have agents managing agents.

Enterprises should expect a more complex strategic picture with competitors (large firms as well as startups) entering “their” industries to disrupt them. In most cases, this will contribute to a commoditization of the bottom (physical) layers of the value stack, and a race to the top, to be closer to the customer. Progress in material science and manufacturing technology will lead to decentralization in manufacturing.

Except for firms supplying precious physical commodities, the only way for enterprises to provide sustainable shareholder value is to become continuously self-renewing. Business model innovation is one aspect of this, but it is not sufficient. The types of business models and the sequence of their introduction determines a firm’s position in an industry, which in turn impacts its capital efficiency.

To accelerate organizational renewal, enterprises must improve their ability to build new disruptive ventures and enter new industries. If they fail to do so, they risk increasing commoditization in existing industries, as the impact of AI and robotics automate more and more activities.

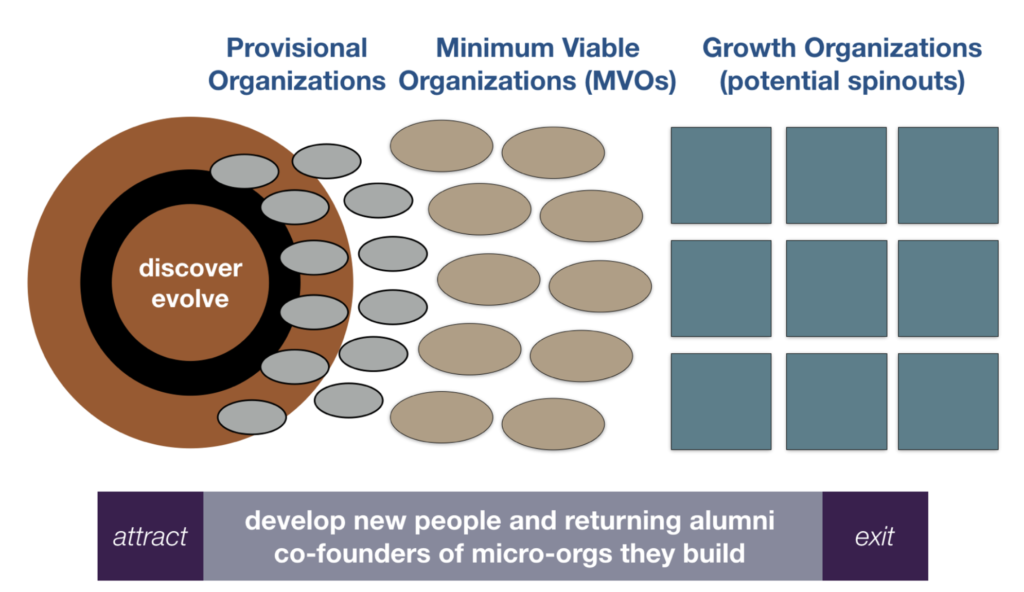

The Higher-Order Organization (H2O) is a powerful approach for building new disruptive ventures. H2Os source capital, technologies, and entrepreneurs from the outside (exopreneurs) and can utilize models such as the Value Stack to detect disruption opportunities in industries. They can be stand-alone entities (examples include Moonwalk in London, Idealab in Los Angeles, and Antler in Singapore), wholly-owned by an enterprise, or formed as joint ventures.

H2Os are complimentary to Corporate Venturing, R&D Centers, Technology Scouting, and other innovation strategies employed by large enterprises. They separate new venture creation from digital modernization efforts, avoiding the political challenges with introducing radical new thinking into mature businesses. Idealab alone has achieved 45 IPOs from the 150+ ventures they have created thus far.

Figure 2: The higher-order organization

Enterprises that survive the post-industrial transition will have automated, reinvented, or divested their mature business units. Most of their future growth will likely come from the new businesses they are able to create.

Post-industrial enterprises will look very different from today’s large organizations.

Strategically, they will largely be focused on new business creation and will seek to create and shape entire industries by building and enabling collaborative networks of ventures. Individual ventures may be short-lived and, in most cases, will have a small number of people. The enterprise network as a whole, however, may be long-lived and resilient.

Operationally, routine work will be automated and intelligent agents used both inside and outside the firm to coordinate work and talk to customers and suppliers. Humans will collaborate with AIs in self-renewing networks, which will replace today’s hierarchies and silos.

Individual nodes (businesses) in the enterprise network will be linked via machine-to-machine interfaces managed by AIs. Distributed ledgers and smart contracts will ensure integrity and transparency. Many mature enterprises today are relatively closed to the outside world. Post-industrial enterprises will be more porous and geared for ongoing collaboration with and exploration of the outside world.

The governance of post-industrial enterprises will be multi-layered. The top layer will focus on the network of constituent businesses, which will be relatively autonomous and have their own governance mechanisms. AIs will play an important role in governance on both levels.

The culture of post-industrial enterprises will be much more individualistic than in large corporations today. Roles and opportunities will shift as individuals participate in creating or developing ventures, and they will prosper to the extent that they are adding new thinking and ideas to the network.

In the industrial era, the Lean Leadership model epitomized the idea of leaders as long-term mentors, developing and empowering people as problem-solvers and innovators over the span of their careers. With dramatically shorter employee tenures, this model is no longer tenable. We are developing a new Post-Lean leadership model in which mentorship is decoupled from firms and where leaders work with a rapidly changing landscape of just-in-time teams.

Figure 3: Stages of enterprise evolution

In this article, we have discussed five stages of development for enterprises: legacy businesses, digital modernization, digital business models, higher-order organizations, and the post-industrial enterprise. The state of the enterprise may differ across its portfolio of business units, some of which may be shut down or divested instead of developed further.

The do-or-die challenge for enterprises now is to accelerate their transformation. This will require courageous leadership and a board willing and able to support the executive team in making bold changes. Operational excellence will still be important, but corporate renewal must be viewed as critical to near-future survival, not merely a means to near-term growth. Renewal is not merely imperative, it is also urgent. Every enterprise is facing faster-moving competitors.